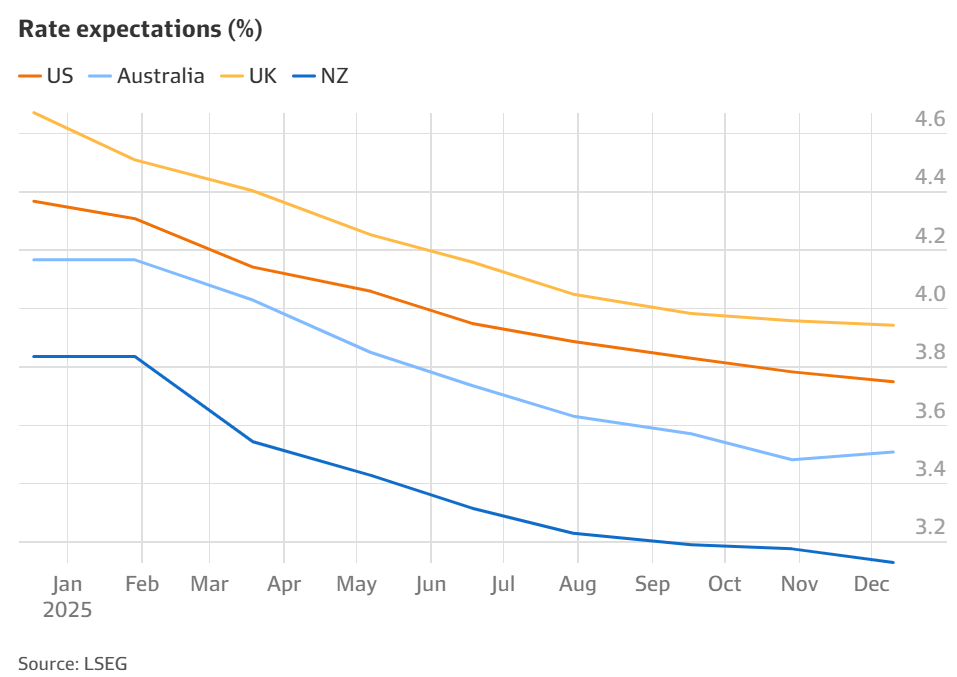

Financial markets have fully priced in dual interest rate cuts at the Reserve Bank of Australia’s (RBA) board meetings in April and May after the central bank adopted a more dovish tone in Tuesday’s monetary policy statement.

Bond traders now expect at least three interest rate cuts from the RBA during 2025.

This would take the official cash rate to 3.60%, which is close to the middle of the RBA’s neutral rate estimate, i.e., when monetary policy is neither stimulating nor restricting economic growth.

Barrenjoey’s chief rate strategist Andrew Lilley says the RBA is likely to adopt the Bank of England’s stance and reduce the cash rate gradually.

In contrast, the Reserve Bank of New Zealand and the Bank of Canada have delivered rapid and deep interest rate cuts.

Judo Bank chief economist Warren Hogan remains the outlier, claiming “the markets have got it wrong (again) on rate cuts” and that the economy is strong.

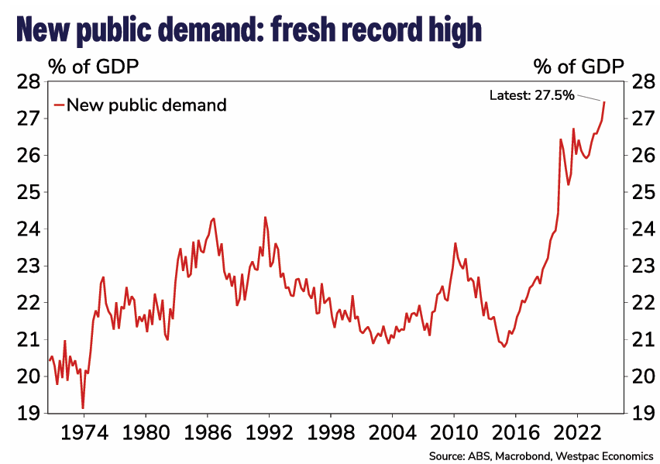

“What 2024 has taught us is that the central bank’s narrow path strategy is not playing out – the economy has proved incredibly resilient, and rapidly rising government consumption spending is completely inappropriate”.

“Fears of an economy getting knocked off balance by 425 basis points of rate hikes have not been borne out”.

“Booming employment, rapid credit growth and, more recently, a 25% surge in consumer sentiment since July show the Australian economy has absorbed the largest “nominal tightening” of monetary policy in 30 years”…

“The [Q3 national accounts] data showed the strongest real household disposable income growth since the start of the tightening cycle, which could foreshadow a recovery in consumer spending heading into 2025. But the market is ignoring this”.

“Stronger consumer spending is evident in the September and October data”.

I obviously disagree with Hogan’s view of the economy.

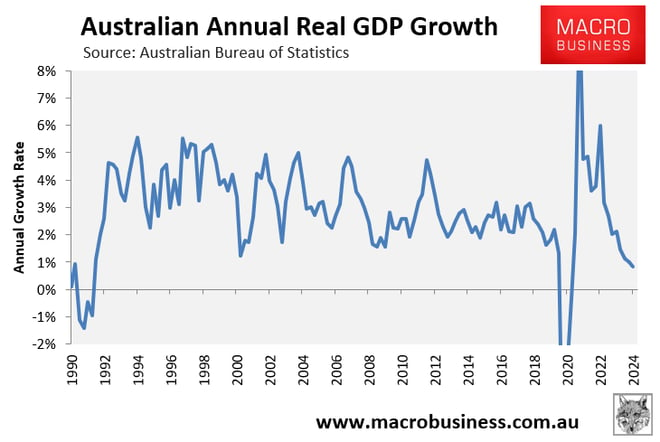

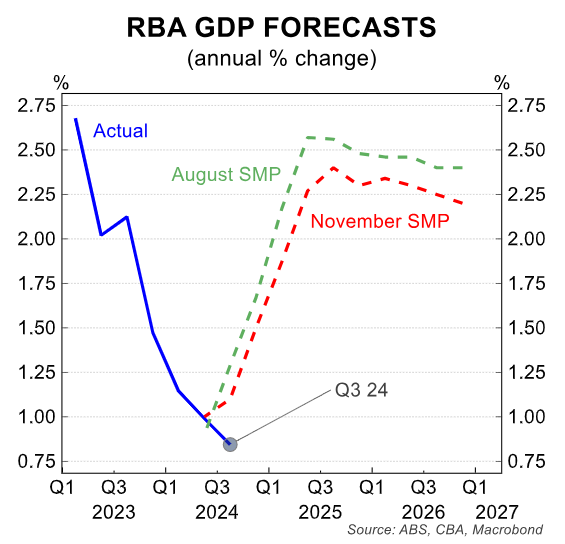

Annual real GDP growth was the weakest since December 1991 and per capita GDP has contracted by a record seven consecutive quarters.

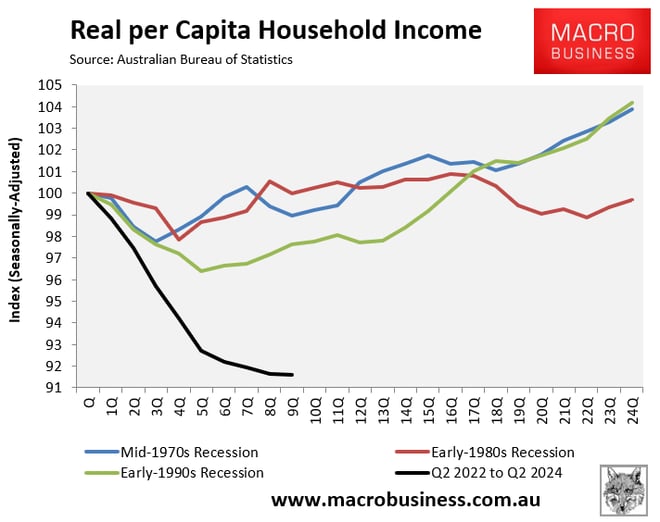

Real per capita household disposable income has also collapsed by 8.4% since Q2 2020.

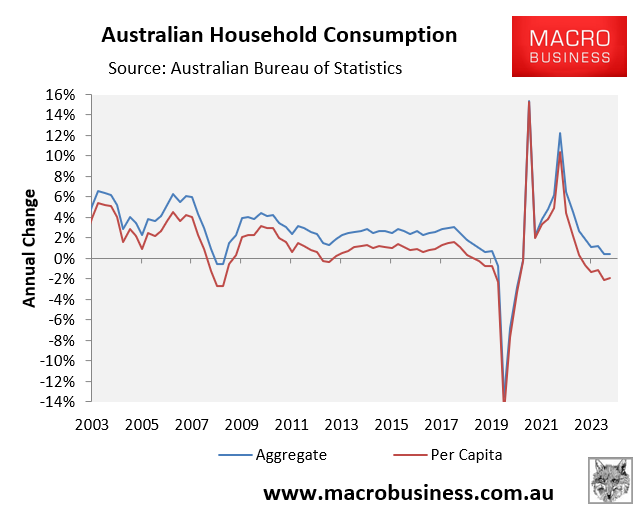

Aggregate and per capita household consumption growth has also tanked.

The only thing preventing an outright technical recession is historically strong population growth (immigration) and record public spending.

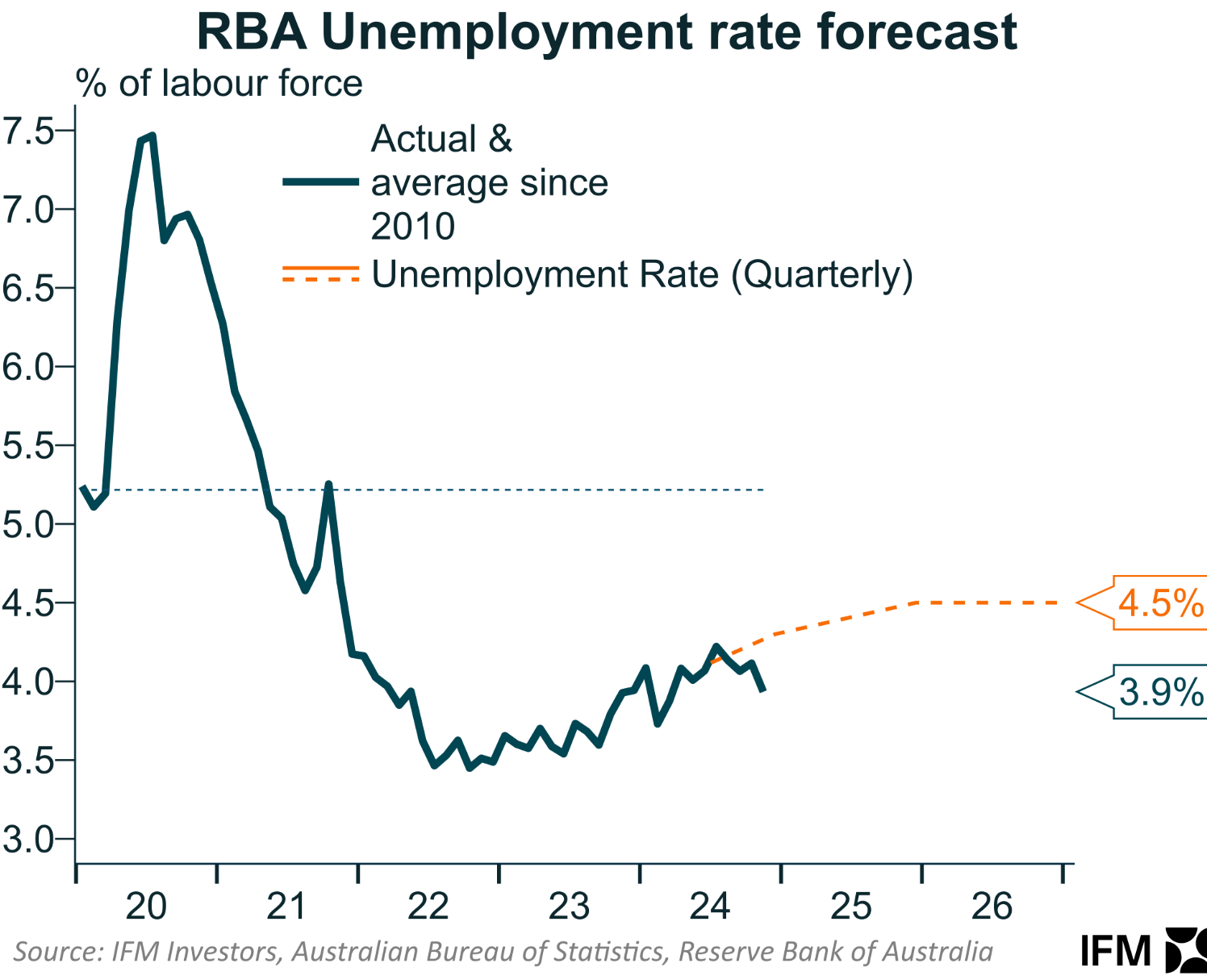

That said, the latest fall in Australia’s unemployment to 3.9% in November complicates the picture.

Australia’s unemployment rate is tracking below the RBA’s forecast.

However, real GDP growth is also far weaker than the RBA had anticipated.

The Q4 2024 CPI (due 29 January) will need to come in soft to green-light a February rate cut (February Board decision on 18/2).

Tags:

Articles

December 13, 2024