Goldman on the EUR rocket.

Based on our models, the Euro’s surge this week went far beyond its typical relationship with 1-year growth expectations (even if we allow for a more front-loaded shift than our economists expect) and, to a lesser degree, the currency also strengthened more than can be explained by higher Bund yields.

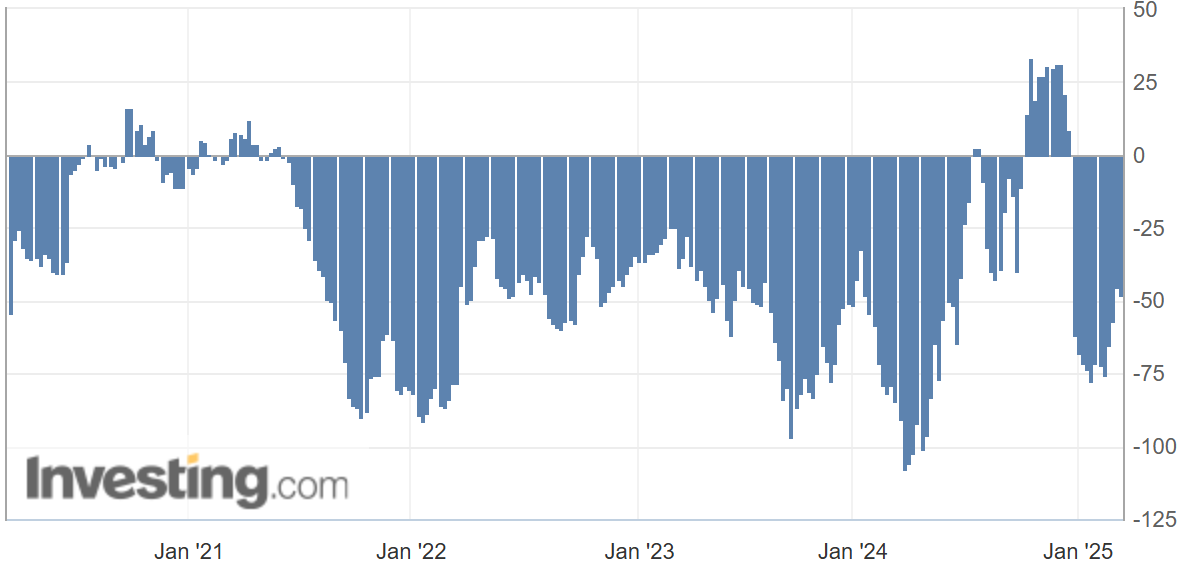

But, when we consider the signal from a broader set of cyclical assets using our refreshed GSBEER models, then the Euro strength looks well-justified (Exhibit 1).

We have argued that either the market is taking a stronger view on near-term growth implications than we are or it is giving more credit to future growth prospects than is typical.

It is likely a mix of both, but the latter explanation increasingly seem to be the dominant factor.

This seems reasonable to us.

...the route to a structural change now appears much wider. But this is not to say the road is without potential potholes ahead.

Beyond the near-term uncertainty of getting the proposal passed, which seems likely but not assured, we also emphasize that this is a top-line number, and ultimate delivery could be underwhelming in both size and scope.

It could be. But Trump has made this an existential challenge for the EU. They step up here to repulse Russia, or they allow it to encroach in ways unseen since the Rad Army took Berlin in 1945.

I think they will get enough done.

My base case now is that EUR has an ongoing tailwind while Trump's chaotic fiscal plan does enough harm to trigger the Fed.

But that then sinks DXY and puts a rocket under EUR.

AUD follows EUR, held back by the ongoing Chinese depression.

The AUD is still positioned quite bearishly as well so we're aligning for a pretty good rally here.

However, if Trump overdoes DOGE and stocks get going further to the downside, that'll spook EUR, and AUD even more.

The madman rules all.

Tags:

Articles

March 12, 2025