DXY is back.

AUD is tariffied.

Auld lead boots is the big question as the tariffs land.

Oil keeps bleeding. Gold to the moon.

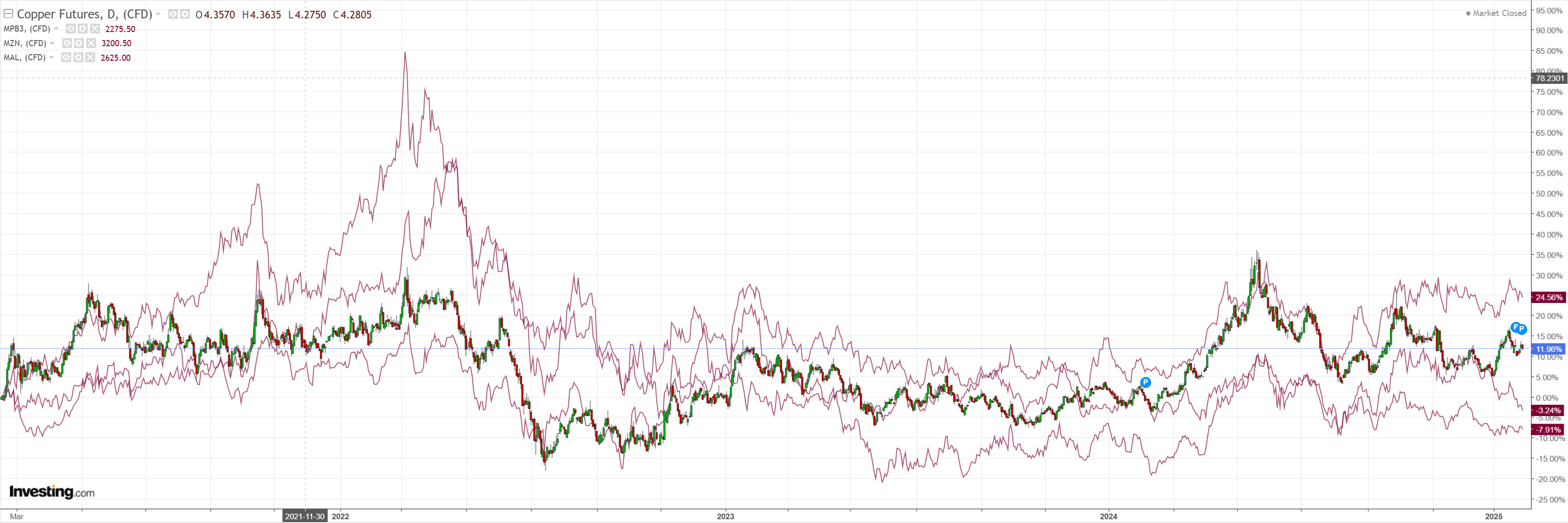

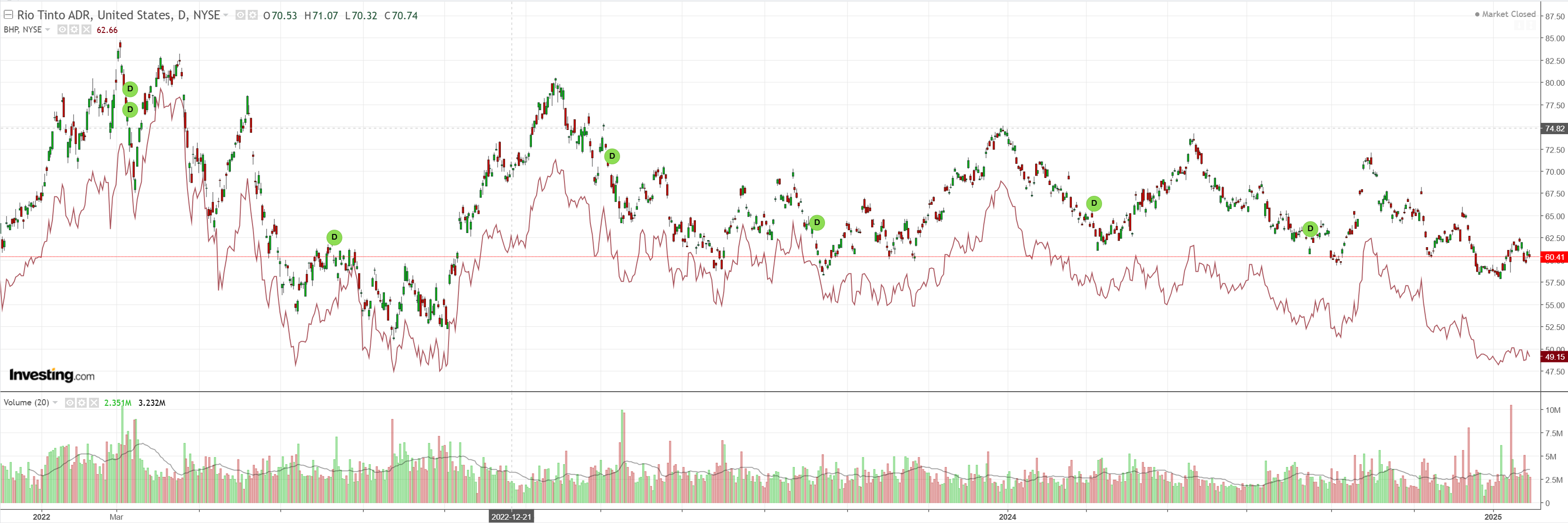

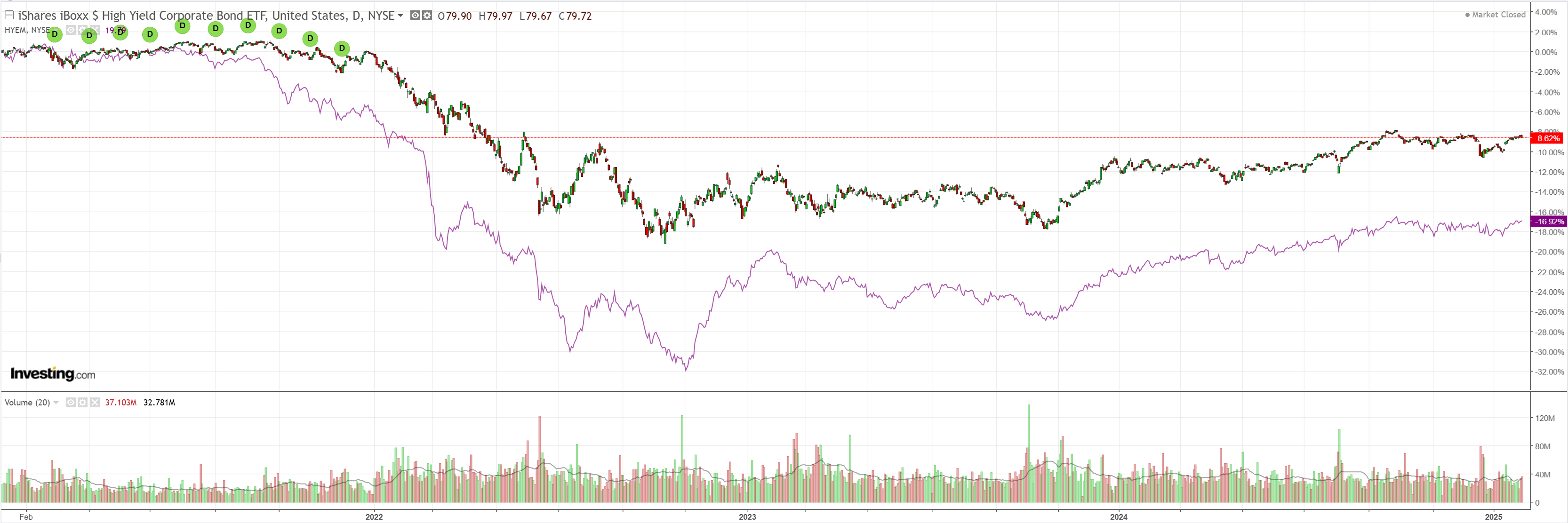

The Crap Complex—dirt, miners, junk, EM—pooed its pants.

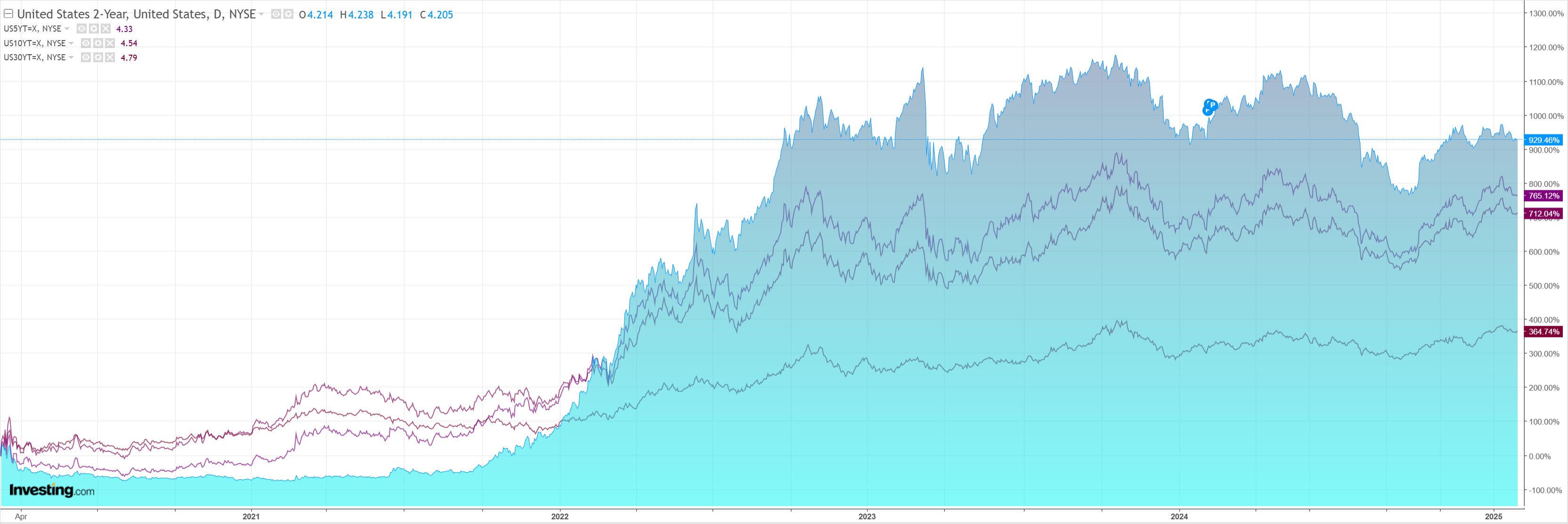

Curve flattened.

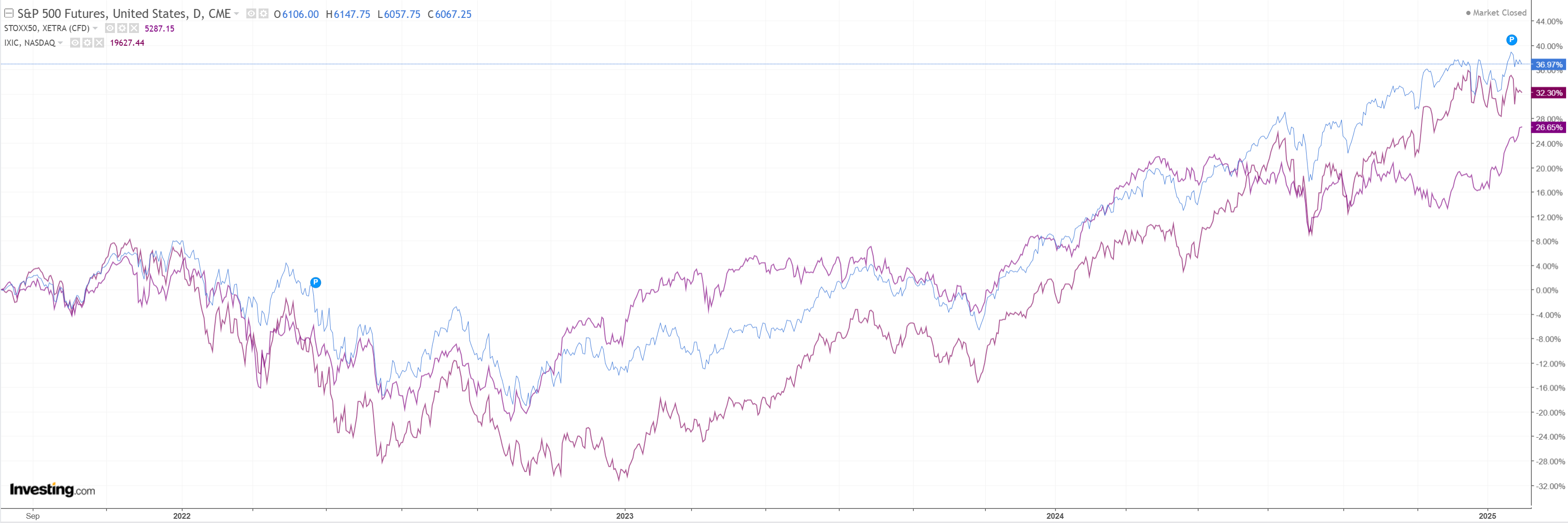

Stocks eased.

Trump applied his tariffs.

“Today, I have implemented a 25% Tariff on Imports from Mexico and Canada (10% on Canadian Energy), and a 10% additional Tariff on China. This was done through the International Emergency Economic Powers Act (IEEPA) because of the major threat of illegal aliens and deadly drugs killing our Citizens, including fentanyl. We need to protect Americans, and it is my duty as President to ensure the safety of all. I made a promise on my Campaign to stop the flood of illegal aliens and drugs from pouring across our Borders, and Americans overwhelmingly voted in favor of it.”

In reality, these are all China tariffs. After the last round, China diverted huge volumes to Mexico and Canada to smuggle into the US.

Not this time.

Goldman has the take.

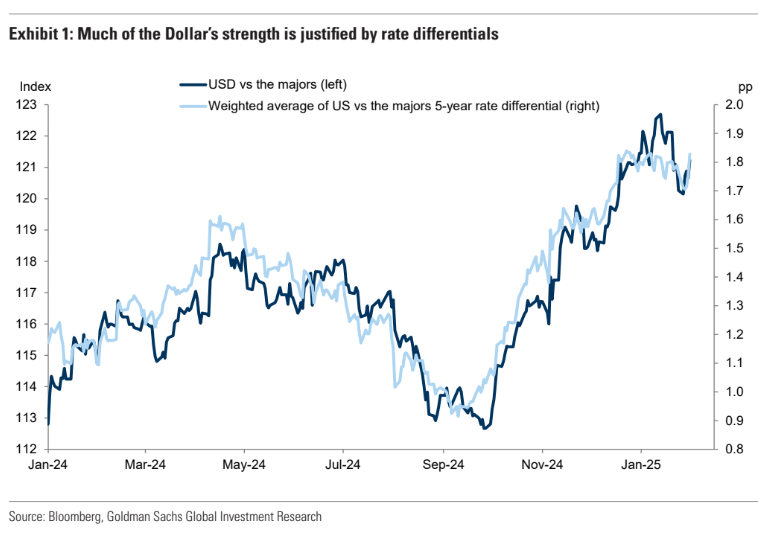

...with much of the Dollar’s strength justified by rate differentials (Exhibit 1) and embedding limited tariff premium at this point, the larger Dollar moves are likely to come to the upside if the tariffs are actually put in place, in our view.

We expect markets to price a high probability that these tariff increases would not be permanent, in line with our economists’ expectations, and therefore the initial FX adjustments should fall well short of our estimates of how much exchange rates typically adjust for a permanent change in terms of trade.

Nevertheless, potential tariffs on China open the possibility of a change in CNY management, which can have reverberations across the market, but again the state of negotiations and potential for a quick reversal makes this more uncertain.

I'm not at all sure one should be so sanguine.

If countries respond in kind instead of negotiating, this will get out of hand.

Art of the deal is back.

AUD flushed.

Tags:

Articles

February 4, 2025