A couple of notes from BCA make some good points about the prospects for Chinese growth.

First up. property! Or, rather down:

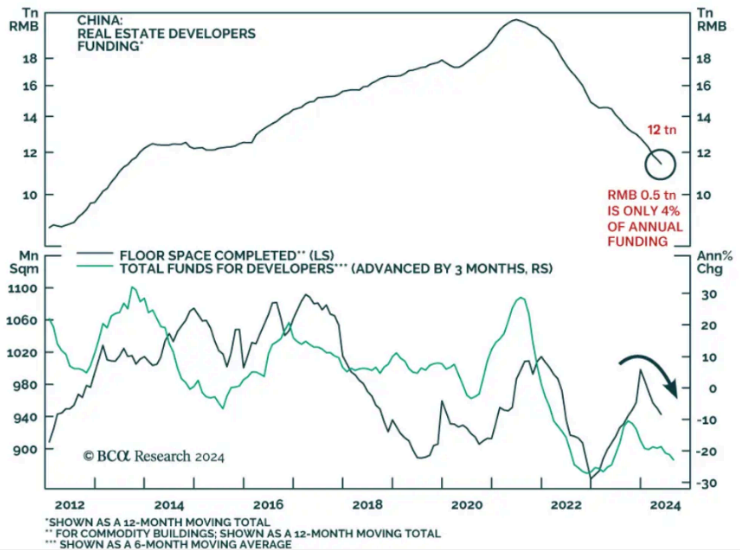

Crucially, the previous CNY 1.88tr funding package was fully dispersed last year. Back of the envelope calculations suggest that replacing the stimulus program with the newly announced CNY 500bn would result in a 9.5% year-on-year decline in property developer funding.

Recall the Goldman outlook for 2025 "completions cliff":

Steel demand is going to keep falling.

Back to BCA and a second note on the implications.

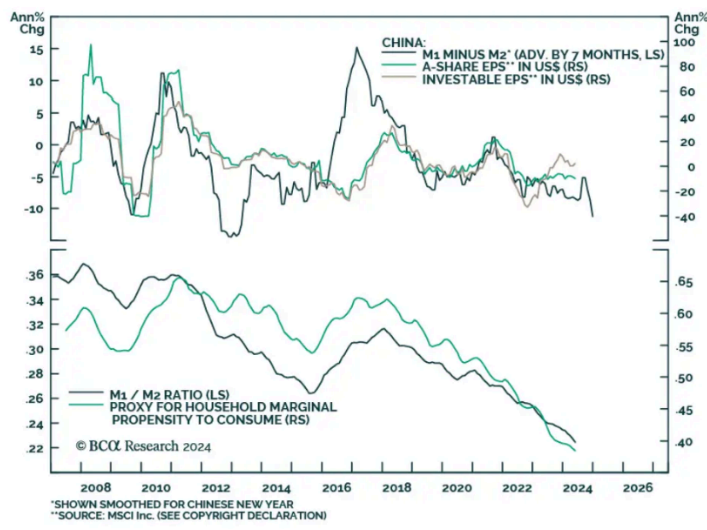

The persistent downtrend in money growth augurs poorly for corporate profits and consumer spending.

The spread between M1 and M2 measures of money supply typically tracks changes in both A-shares and investible shares' EPS.

Meanwhile, the M1 to M2 ratio also tracks households marginal propensity to spend.

Poor household and corporate demand are also reflected in lackluster appetite for credit.

The total social financing impulse continues to decline on a 3-month moving average basis.

Notably, the measure excluding local government bond issuance is now -1/7% of GDP and is an accurate reflection of the private sector's appetite for credit.

Ultimately, our China investment strategists expect minimal incremental stimulus efforts given conditions merely sluggish, not collapsing.

The authorities are also likely waiting to gauge effects from the latest housing market rescue package before undertaking more stimulus measures.

With lackluster domestic conditions, the authorities' growth targe relies heavily on exports.

However, the external environment is unfavourable given headwinds from increasing trade tensions and the transitory nature of the global manufacturing cycle's stabilisation.

Weakening growth and deflation as far as the eye can see.

Tags:

Articles

June 25, 2024