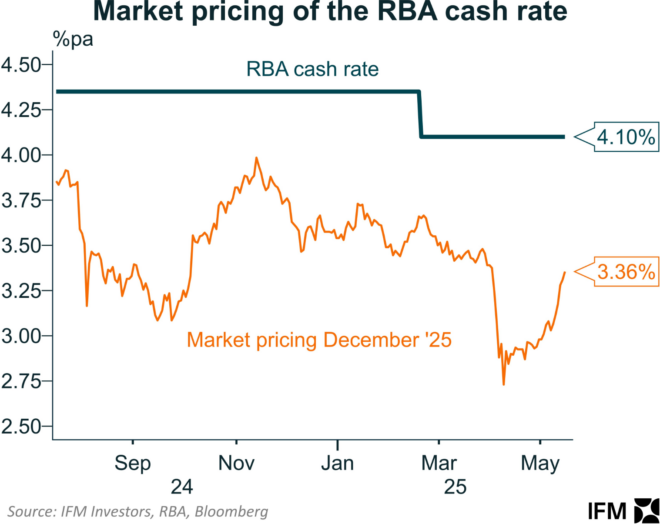

Alex Joiner from IFM Investors has published the following chart showing the sharp reversal of interest rate pricing in the futures market.

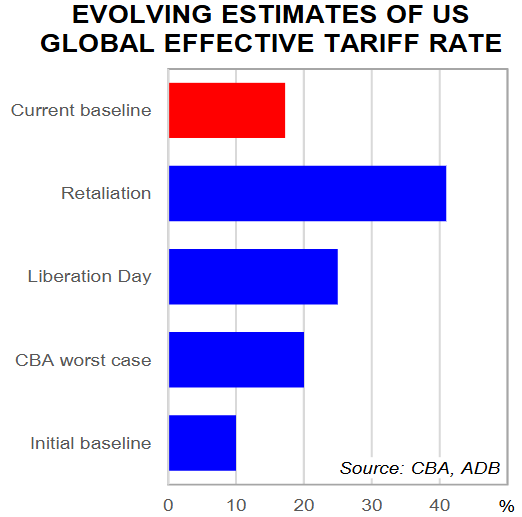

After President Donald Trump announced his ‘Liberation Day’ tariffs last month, the futures market had forecast five more interest rate cuts this year and a cash rate of around 2.85% by the end of 2025.

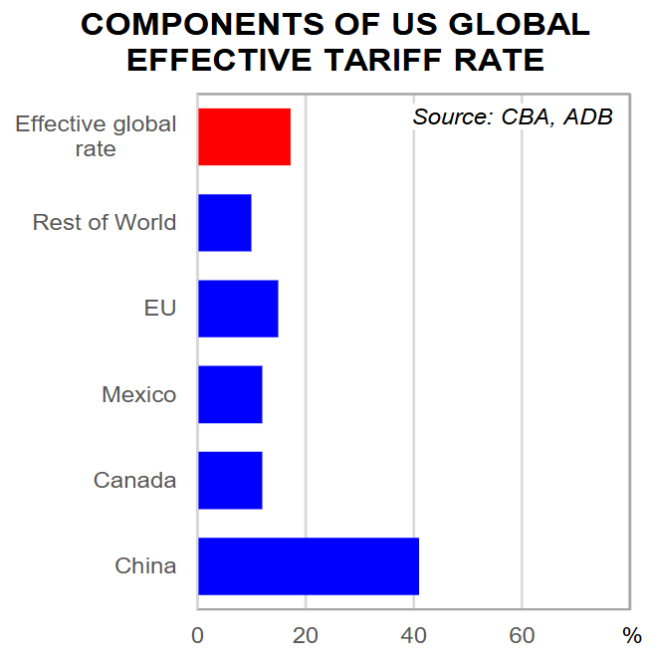

However, the gradual walking back of tariffs by the Trump Administration has seen the global effective tariff rate decline.

As a result, the expected impacts on global GDP growth from the tariffs are not as severe as feared.

Global share markets rebounded and futures markets have lowered their forecasts for rate cuts.

The futures market is now aligned with CBA and Westpac, which both predict three further rate cuts this year and an official cash rate of 3.35%.

NAB remains the dovish outlier, forecasting four rate cuts by Q3 2025, 2.85% by year-end, and 2.60% in February 2026.

The flow of domestic data and external events will, obviously, shape the outcome.

May 16, 2025