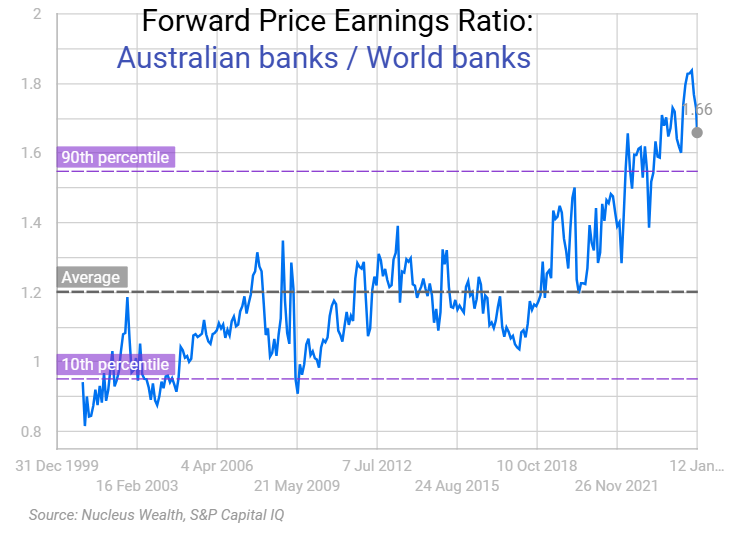

The bubble of a lifetime in CBA shows no signs of bursting at 26x growthless earnings.

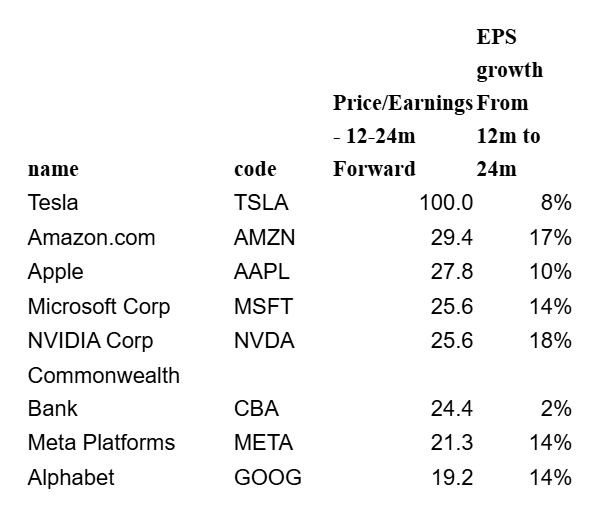

Hilariously, on two-year forward earnings, CBA is the Magnificent 8th!

And Aussie banks are plain stupid in context.

I still maintain that this bubble is going to burst when rate cuts begin.

The mass immigration economy does not do wage growth nor, therefore, sustained inflation.

As more cuts than expected come, net interest margins will be the pin that bursts the bubble.

Or maybe CBA will go to 50x.

Tags:

Articles

Post by David Llewellyn-Smith

January 22, 2025

January 22, 2025

David runs a prominent investment blog, co-authored of The Great Crash of 2008 with Ross Garnaut, was the editor of the second Garnaut Climate Change Review and was former editor-in-chief of The Diplomat magazine. For years, Damien and David discussed the potential to create an investment firm to invest in the themes that both had pursued independently, and by 2016 platform fees had reduced low enough that the strategy could be invested in without the investment platforms making more than the investors! David is the Asset Allocation strategist, his main role being to drive debate and decisions on whether to own cash, bonds, Australian stocks or International stocks.