Goldman’s Andrew Boak has been more right than everyone so far.

In her post-meeting press conference RBA Governor Bullock noted that today’s decision to keep the policy rate unchanged at 4.10% was a consensus decision and that the Board did not explicitly consider a rate cut at the meeting.

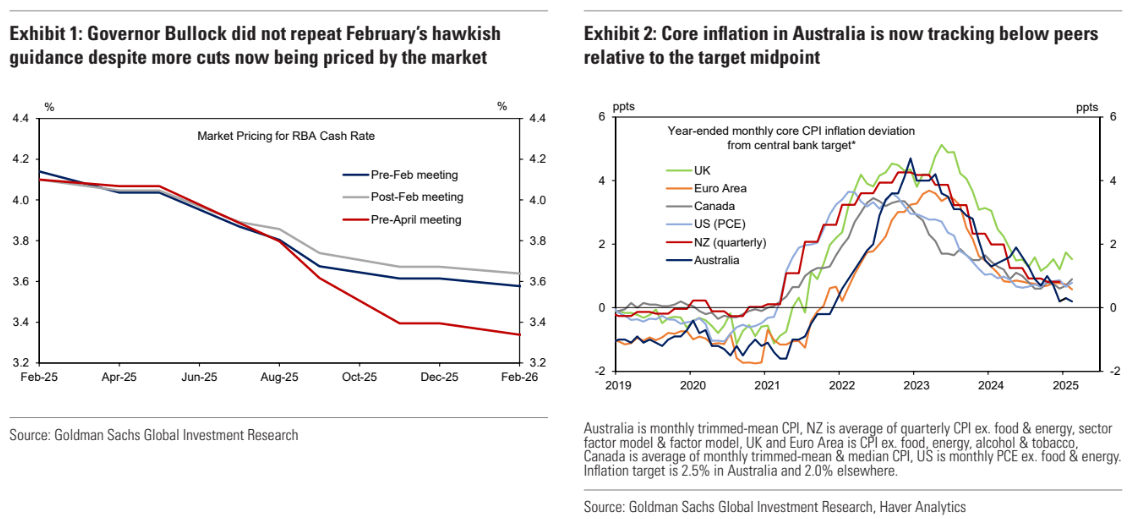

Importantly, Governor Bullock did not repeat February’s guidance that financial markets are pricing too much easing this year – despite financial markets now pricing significantly more easing later this year (Exhibit 1).

Maybe that’s because she has overshot the target!

HSBC’s Paul Bloxham adds what MB has been saying for months.

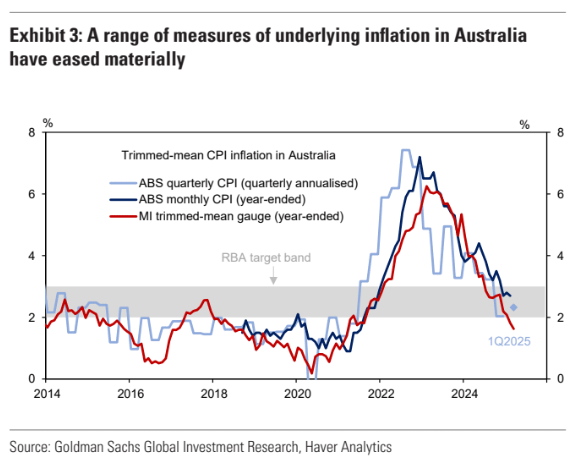

Finally, rising global trade tensions may drive a decrease in imported prices, lowering overall inflation and allowing the RBA to cut rates more, supporting local growth. One mechanism would be slowing global growth, which is typically disinflationary. Another is that raising trade barriers for China’s manufactured exports, particularly to the US, could drive Chinese producers to look for other markets to sell their wares.

Why has the RBA not drawn this conclusion for itself? It is basic economics.

The Bullock RBA is so cautious and reactive that it couldn’t predict the sun coming up for fear of a cloudy day.

This only means that monetary policy is run too tight for too long, meaning it will ultimately have to go lower than it probably should.

This is the precise opposite of what RBA reform was supposed to achieve.

Tags:

Articles

April 4, 2025