Treasurer Jim Chalmers says the federal government undertook a “very robust and very consultative” process to select the members of the Reserve Bank of Australia’s (RBA) two new boards, which will come into effect on 1 March 2025.

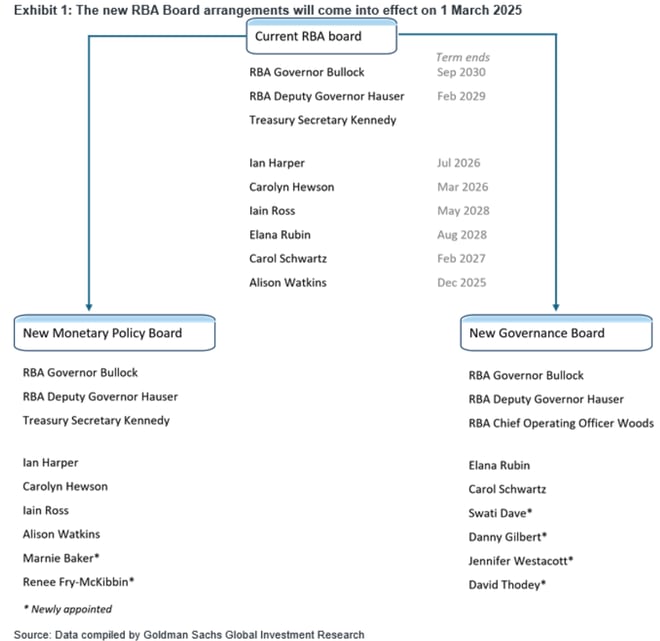

Professor Renee Fry-McKibbin and former Bendigo Bank CEO Marnie Baker will join four of the RBA’s current external board members on the new interest-rate setting board, which will also include governor Michele Bullock, deputy governor Andrew Hauser and Treasury secretary Steven Kennedy.

Current board members Carol Schwartz and Elana Rubin will join the RBA’s governance board.

Andrew Boak from Goldman Sachs has compiled the following graphic summarising the changes.

As you can see, the new interest-rate setting board is similar to the existing board. Four of the six external members are unchanged, with Marnie Baker and Renee Fry-McKibbin replacing Elana Rubin and Carol Schwartz, who have switched to the new Governance Board.

Realistically, I cannot see any significant impact on how interest rates are set. Nor do I see the new Governance Board changing the course of interest rates.

The RBA board changes are a nothingburger.

Tags:

Articles

December 17, 2024