Australia has traditionally had a gaping trade deficit with the United States.

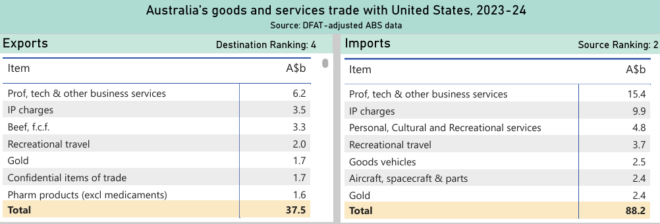

The following table from Australia’s Department of Foreign Affairs and Trade (DFAT) shows that the United States exported (A$88.2b) more than double what it imported (A$37.5b) from Australia in 2023-24.

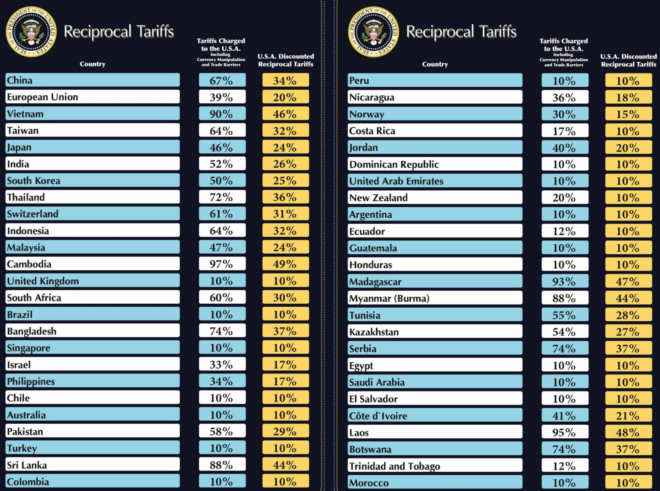

On Wednesday, the Trump Administration levied reciprocal tariffs against all nations.

The Trump administration’s calculation of reciprocal tariffs is nonsensical. It has calculated the tariff charged on US goods as the US trade deficit divided by US imports from that country. It has then levied a reciprocal tariff of half, with a minimum tariff of 10%.

As noted by Alex Joiner from IFM Investors on Twitter (X):

“The US trade deficit with Australia is ~A$19.9billion (the US has an annual trade surplus with Australia)/US imports from Australia are A$31.6billion = this implies the tariff charged to the USA is -63%. Using the discount framework of roughly 50%, we should be attracting a -31% tariff from the US”.

Instead, Australia got charged the minimum 10% rate. I guess we should feel privileged to have received only the 10% baseline tariff.

According to the above chart from DFAT, beef was Australia’s third largest export to the United States in 2023-24, valued at A$3.3 billion.

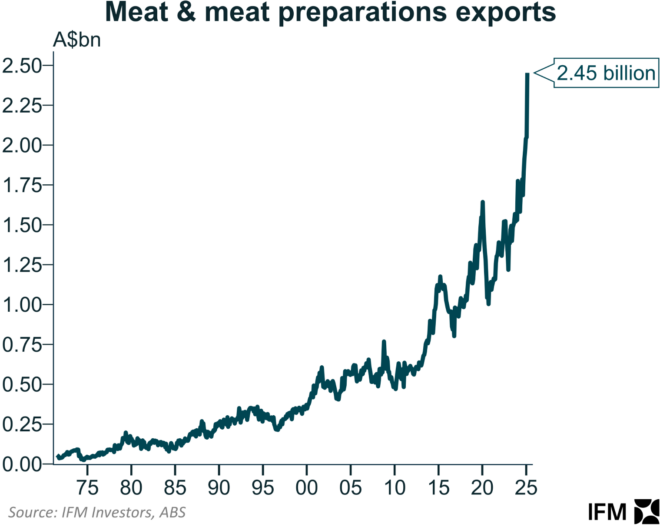

Ironically, Aussie beef exports soared in February before the announced tariffs, hitting a record high of A$2.45 billion.

Hilariously, the surge in beef exports resulted in a rare monthly trade surplus with the United States.

“Some irony that in monthly terms Australia’s historical trade deficit with the US turned to a surplus in recent months on exporters responding to the threat of tariffs”, noted Alex Joiner.

The Trump administration has shown that it sets trade policy without rhyme or reason.

President Trump has effectively torn up the Free Trade Agreement with Australia, which was heavily in the United States’ favour anyway.

Tags:

Articles

April 4, 2025