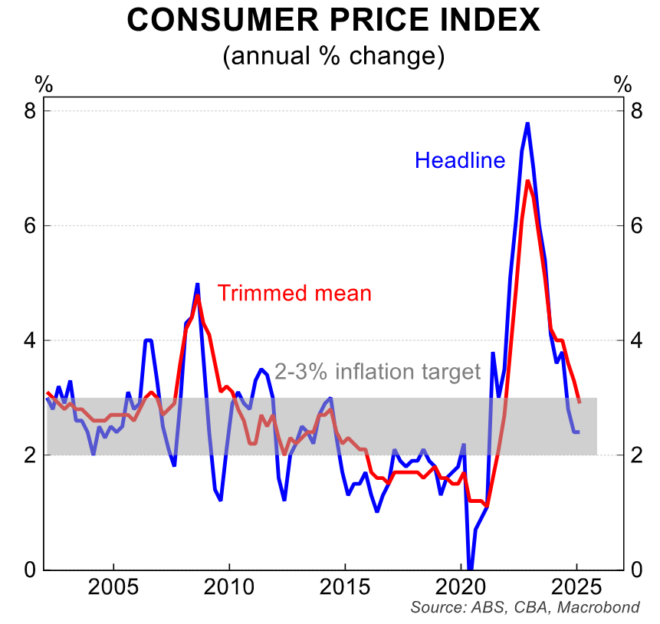

This week’s CPI data from the Australian Bureau of Statistics (ABS) confirmed that the post-pandemic inflation surge is firmly in the rearview mirror.

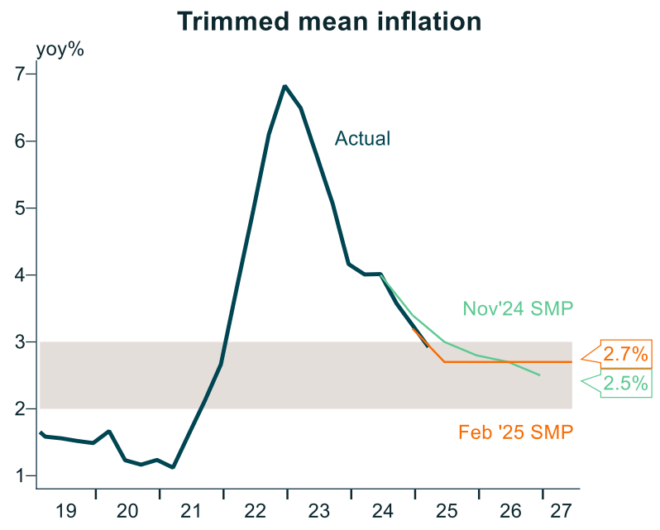

Australia’s policy-relevant underlying inflation fell to 2.9% in Q1 2025, to be tracked within the Reserve Bank of Australia’s (RBA) target range of 2% to 3%.

The pace of disinflation was also in line with the RBA’s expectations.

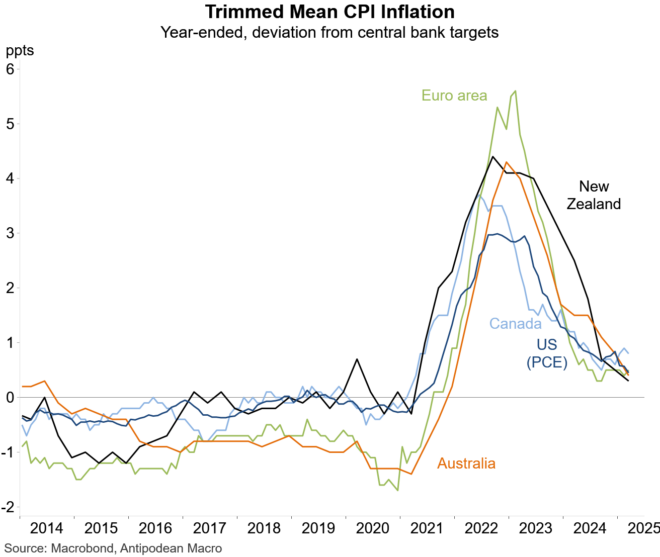

Despite the different monetary policy paths across central banks, the disinflation of trimmed mean inflation across advanced markets has been similar. This is illustrated clearly below by Justin Fabo from Antipodean Macro:

Annual trimmed mean inflation across these economies was broadly similar in Q1 2025.

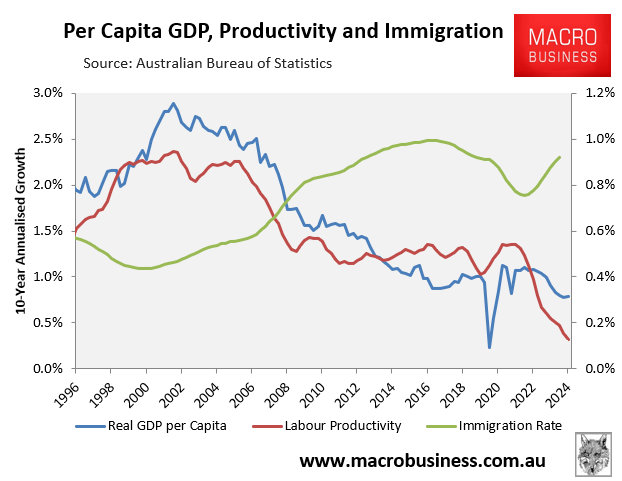

Concerns about inflation have now given way to growth concerns following the Trump administration’s tariff war.

The International Monetary Fund’s (IMF) latest World Economic Outlook downgraded Australia’s GDP forecast for 2025 from 1.6% to 2.1%. If true, it would extend the economy’s weakest period of growth (outside of the 2020 pandemic) since the early 1990s recession.

The IMF also downgraded global growth by 0.8% over the next two years.

“Major policy shifts are resetting the global trade system and giving rise to uncertainty that is once again testing the resilience of the global economy”, the IMF said in the document.

Tags:

Articles

May 2, 2025