More from the RBA's new deputy, Andrew Hauser:

“Mark encouraged us to be challenging about the assumptions that we were making and to reach out to the outside world to understand the structural changes that were going on,” says Hauser.

“You cannot have groupthink at a central bank,” he adds. “You have to challenge yourselves – where could you be wrong?

“You have to embrace diversity in its true sense, which is a range of views. The crazy guy in the room, or the person with a different perspective, should have a voice. Because we’re learning. We’re trying to understand how to navigate a different, more complex world.”

OK, then, I will rise to that challenge. Here is what this crazy guy in the room says:

While labor market expansion brought about by mass immigration drives economic growth, the RBA will never achieve its price stability objective in Australia.

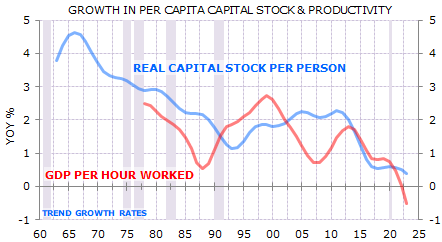

In periods of global shortage, such as the period we have just passed through, Australia will suffer more than most owing to capital shallowing, which will deliver chronic shortages in key economic segments such as housing and infrastructure.

In periods of global surplus, the RBA will struggle to keep inflation high enough because the permanent labour supply shock means weak wages become entrenched.

This means a larger amplitude of monetary policy swings.

In other words, because business investment is secondary to labour market expansion in the model, inelastic markets will consistently boom and bust, productivity will remain low and, contrary to popular thinking, wage growth will be a permanent source of economic weakness.

If the RBA wants to fulfil its mandate, it must start discussing what constitutes a growth model that lifts living standards (per capita), not political optics (headline) to pressure Canberra.

Tags:

Articles

June 4, 2024