1 Year

9.0% p.a

Have a question? You may find the answer on our Frequently Asked Questions page.

If not you can call, email, web chat or book in with a specialist:

During business hours we are often available to call or web chat. Otherwise if you have a longer question or are looking for help, we can assist you with:

Our investment team can be harder to catch! But if you if you are looking for help, we can help you with:

Nucleus Wealth employs or subcontracts to financial advisers who can provide general advice about Nucleus Wealth’s investment products. This advice includes things like:

Address: Level 5, 447 Collins Street Melbourne Victoria 3000

Email: contact@nucleuswealth.com

Phone: 1300 623 863 or 03 8658 4038 (Weekdays 9:00am – 5:00pm AEDT)

Nucleus Wealth is currently looking for quality financial advice practices and accountants nationwide that we can work together with, to provide superior financial outcomes for your clients. Please get in touch at contact@nucleuswealth.com

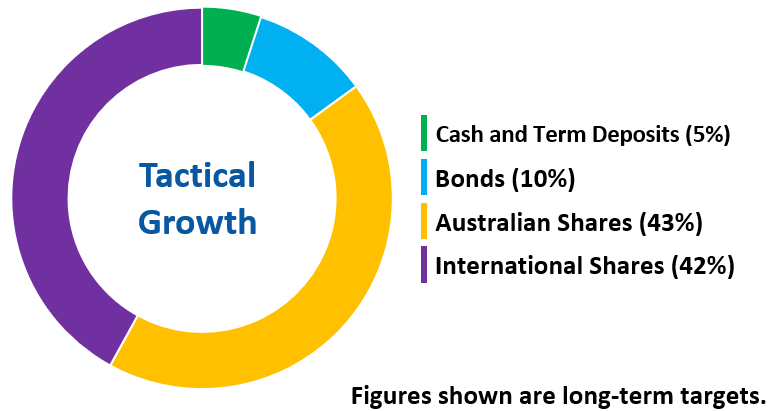

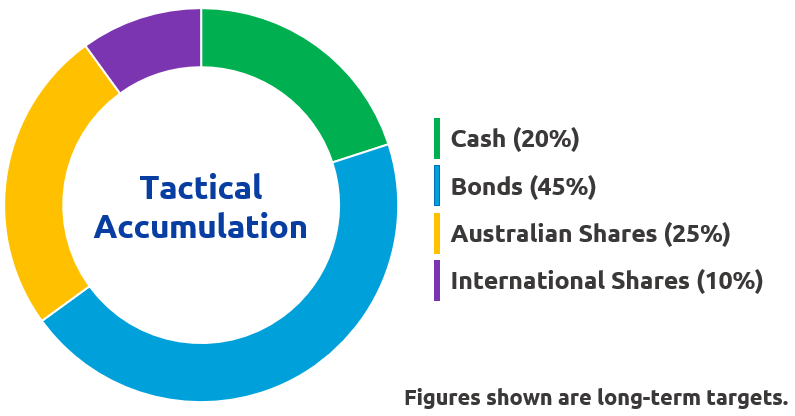

These portfolios feature "Tactical Asset Allocation", meaning the amount of Cash, Bonds and Shares in each portfolio is adjusted by Nucleus Wealth to take advantage of global economic themes and help protect the portfolio during volatile market conditions

Through our onboarding portal you can select any of the portfolios, a blend of several, or receive a recommendation of an appropriate blend for you using our free online advice tool

High growth portfolio for investors who are comfortable with higher levels of volatility and have a longer investment timeframe

Past performance is not an indication of future performance. The above returns are per annum, as of January 31st 2025 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Conservative portfolio for investors who do not have an income requirement

Past performance is not an indication of future performance. The above returns are per annum, as of January 31st 2025 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

High growth portfolio for investors who are comfortable with higher levels of volatility and have a longer investment timeframe

Past performance is not an indication of future performance. The above returns are per annum, as of January 31st 2025 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

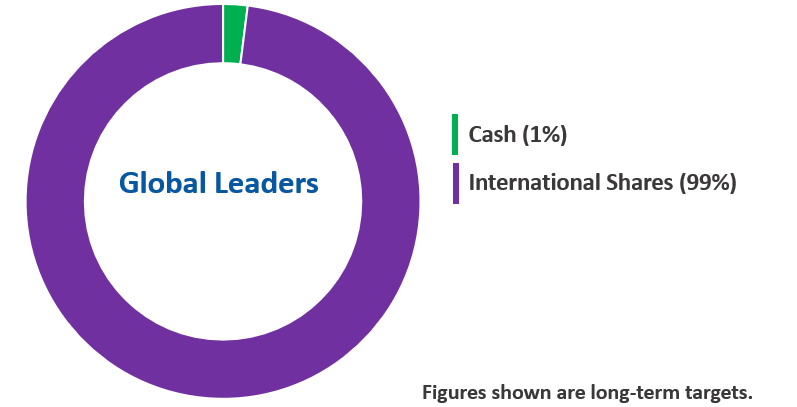

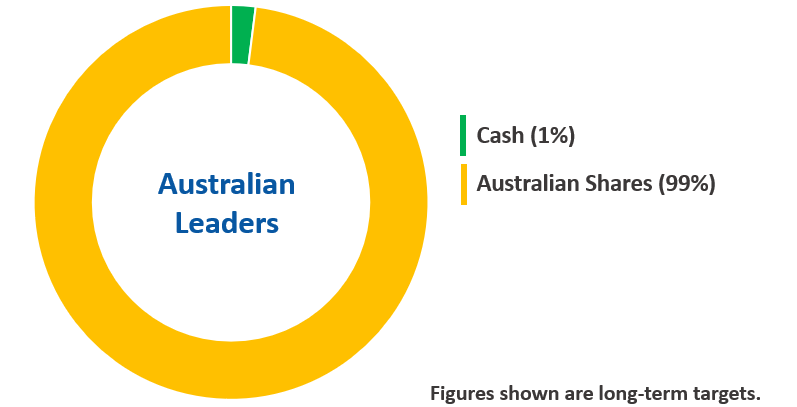

Passively managed investment solutions for those who are happy to receive indexed returns whilst paying lower fees. These portfolios hold only Australian or International shares or ASX listed Bonds, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

A portfolio of the largest global shares by market capitalisation (the number of holdings can be customised by you: between 15 and 75).

Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Global Equities exposure

Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

Minimum investment: $10,000 (platform dependent)

Portfolio is unhedged so investors are exposed to AUD movements

Past performance is not an indication of future performance. The above returns are per annum, as of January 31st 2025 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

A portfolio of the largest ASX listed companies' shares (the number of holdings can be customised by you: between 15 and 75).

Past performance is not an indication of future performance. The above returns are per annum, as of January 31st 2025 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.

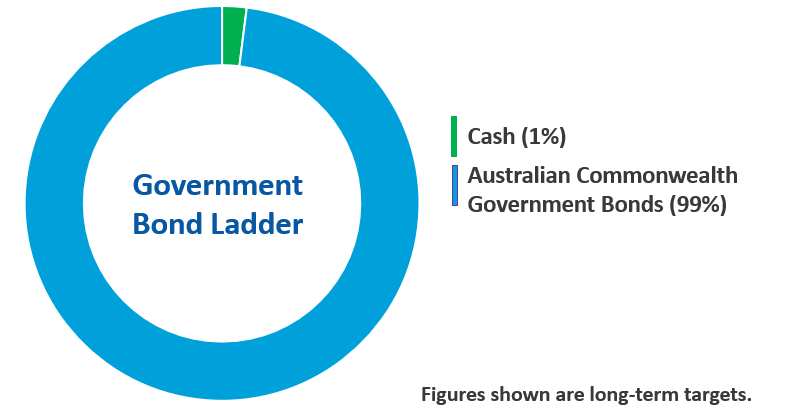

A portfolio of Australian Commonwealth Government Bonds listed on the ASX.

Investment objective: Passively managed portfolio creating a bond ladder using ten to 15 ASX listed Australian Commonwealth Government Bonds of various maturities.

Past performance is not an indication of future performance. The above returns are per annum, as of January 31st 2025 and after investment fees (of 0.11%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here.